|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Interest Rates in Colorado: A Comprehensive Guide for BeginnersUnderstanding Interest RatesInterest rates play a crucial role in determining the cost of borrowing money. They are a percentage of the principal amount charged by lenders for the use of their money. Understanding the dynamics of interest rates can help you make informed financial decisions, whether you're looking to buy a home, refinance, or invest. Current Interest Rates OverviewIn Colorado, interest rates can vary based on the type of loan and the lender's terms. As of now, mortgage rates are generally competitive, but it's essential to shop around to find the best deal. Factors such as credit score, loan amount, and loan term can influence the rate you receive. Factors Affecting Interest RatesCredit ScoreYour credit score is one of the most significant factors affecting your interest rate. A higher credit score often results in lower interest rates. Loan Type

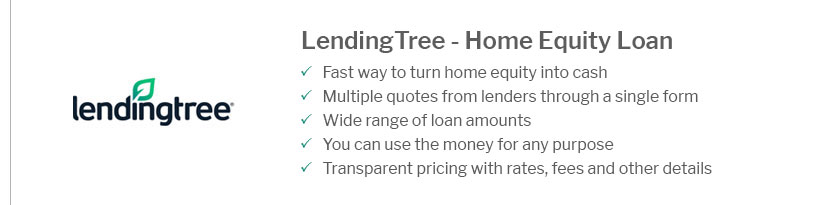

Economic ConditionsInterest rates are also influenced by broader economic conditions such as inflation, employment rates, and Federal Reserve policies. Finding the Best RatesTo find the best interest rates in Colorado, it’s advisable to compare offers from multiple lenders. This includes banks, credit unions, and online lenders. Consider checking out options like best heloc lenders in texas for additional insights on home equity lines of credit, which can also be beneficial. Tips for Securing the Best Rate

FAQ: Best Interest Rates in Colorado

https://www.depositaccounts.com/local/denver/

Top Local Branch Rates ; 4.30%. Western Alliance BankHigh Yield Savings Account by Raisin ; 3.95%. PNC BankVirtual Wallet Checking Pro ; 4.88%. FirsTier Bank7 ... https://www.canvas.org/rates

APR is Annual Percentage Rate (APR). Our HELOC is a variable rate loan; the rate is tied to an index (the Prime Rate) to which a margin is added. Best Rate ... https://www.coloradofederalbank.com/deposits

With savings rates up to 4.25% APY* and CD rates between 0.75%-4.45% APY**, we offer rates that are straightforward, secure and FDIC insured. *Annual Percentage ...

|

|---|